If You’re Considering Solar – 2019 is the Year to Act On It.

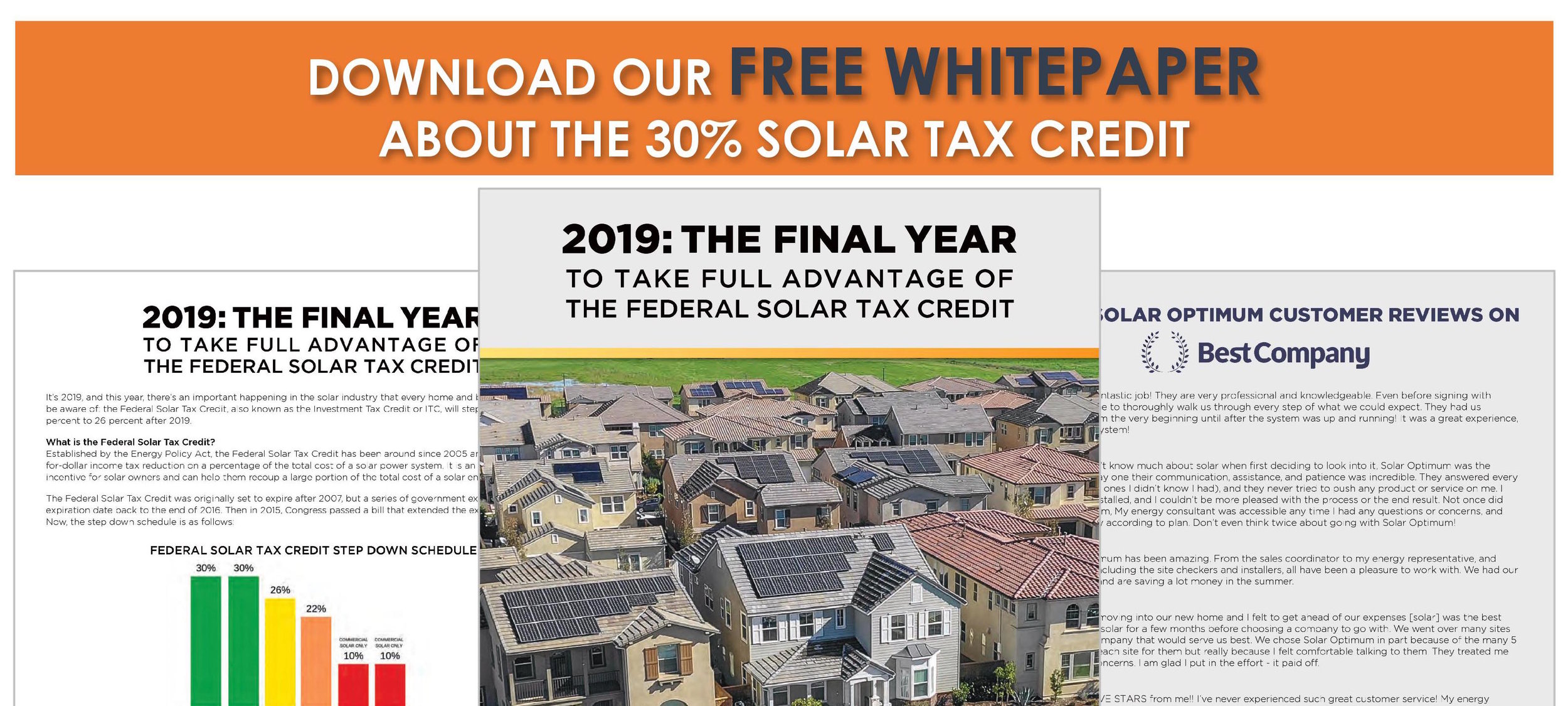

Download a FREE white paper published by Solar Optimum and BestCompany.com

On April 20th, Solar Optimum and BestCompany.com released a white paper entitled: “2019: The Final Year to Take Full Advantage of The Federal Solar Tax Credit”. The white paper explains why anyone interested in getting solar should act fast to make sure to get the most out of their investment because the full 30 percent Solar Investment Tax Credit (ITC) is expiring at the end of this year

What is the ITC?

As part of the Energy Policy Act of 2005, the Incentive Tax Credit or Federal Solar Tax Credit, was created as a way to make solar power more affordable. Up until this point, solar had taken a backseat to traditional – and cheaper – sources of energy such as fossil fuels, but the tax credit opened the door for solar power to become mainstream.

The white paper explains how the creation of the ITC sparked a huge growth in the solar industry – one that lead to the average cost of solar to drop more than a staggering 73 percent.

How is the Federal Solar Tax Credit beneficial?

In two simple words: Enormous Savings. By taking advantage of the full 30 percent ITC, homeowners and businesses will experience tremendous savings. If you purchase a solar system after the December 31st deadline, the rebate amount will be reduced to 26 percent and you could potentially miss out on $1,000 or more in tax credit.

How to make it on time

In the report, Solar Optimum breaks down the steps needed in order to make the deadline for the full tax credit. Not only does the solar system have to be purchased before the end of the year – it must also be approved to operate within that time frame.

The white paper covers:

● An introduction to the Federal Solar Tax Credit

● A historical run-through of why the tax credit was created

● The impact the ITC has had on the solar industry

● What to do if you want to make sure you get the full benefits