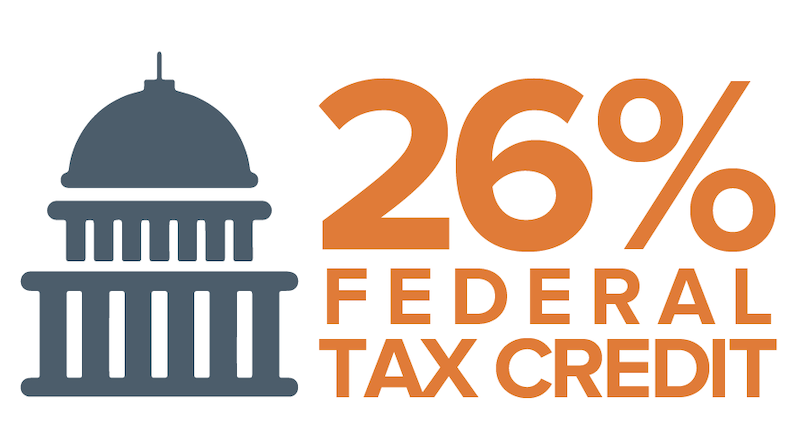

On December 27, a $1.4 trillion federal spending and tax extension package was passed by congress alongside a $900 billion coronavirus relief package. Incorporated in the package were several clean energy provisions – including a two-year extension of the Investment Tax Credit (ITC) of 26%.

The ITC was originally scheduled to decrease from 26% to 22% in 2021, but with the new bill, homeowners will now still be able to get a 26% tax credit if they are buying solar panels before the end of 2022. In 2023, the ITC will drop to 22% for homeowners – and it expires in 2024.

The largest stimulus bill in U.S. history supports solar homes

The relief package is the largest of its kind in the history of the USA, and with its focus on clean energy, homeowners across the country can look forward to saving even more money when making their solar panel investment.

“We are extremely pleased with the outcome of this relief package,” said Rainier de Ocampo, VP of Marketing at Solar Optimum. “The Investment Tax Credit is a great help for homeowners looking to get residential solar panels because it can save them thousands of dollars. Now that the 26% credit has been retained for another two years, many people who perhaps didn’t have the opportunity to commit to solar in time to get the full credit can now still save money when buying solar panels for homes”. he said.

House Speaker Nancy Pelosi (D-Calif.) highlighted the energy provisions included in the bill in a press release summarizing the content of the legislation.

Don’t wait too long – act now to ensure your tax credit

With the extension of the 26% ITC, solar panel companies across the country are busier than ever. In order to receive the tax credit, a solar system must be installed and approved for operation before the end of 2022. This means many homeowners have already received quotes, and some are in the process of completing an installation.

“We are very happy for California’s homeowners getting two more years of the 26% tax credit on their new solar panel installation,” said de Ocampo. He continues, “But even with the extension, we advise that if you are considering a solar system for your home that you don’t wait. The truth is, the sooner you install your solar panels, the more savings you’ll experience. And with the 26% solar tax credit, you experience tremendous savings right off from the start!”

Unsure if solar power is beneficial for you?

If you are still wondering if solar panels are worth it, there are several factors to consider. These include your electricity bill, where you live – and if your home is even suitable for solar. Most homeowners in California can benefit from solar, so don’t hesitate to reach out to one of Solar Optimum’s energy experts for a free consultation to see if solar is right for you – and to learn how much you can potentially save by going solar.